This article is the second part of our series covering important medical billing terms to help you improve medical billing knowledge. At the end of this article we will add a link to the first part. In this part, we will be delving into four more essential terms in medical billing:

-

QW modifier

-

Upcoding

-

Local Coverage Determination (LCD)

-

National Coverage Determination (NCD)

But before that, here is a quick recap of what we covered in part 1 (skip this bit if you’ve already been through the content):

ERA (Electronic Remittance Advice)

An ERA is a form of electronic communication to cut paper-based explanations of benefits (EOB).

RVU (Relative Value Unit)

The RVU is a standardized set of values Medicare assigns to determine the cost of certain services. RVU is a method for calculating payment for medical services.

ABN (Advanced Beneficiary Notice)

Advanced Beneficiary Notice (ABN) is also known as a waiver of liability. It is a notice given by a healthcare provider to the patient before performing a service. It is generally considered if they have reason to believe that a patient’s Medicare insurance will not cover the procedure.

Clearinghouse

Clearinghouses are third-party intermediaries that process and submit claims to insurance companies.

Now for Part 2:

Modifier QW

Prerequisite Knowledge: What is a Modifier in Medical Billing?

A modifier is a two-digit code added to a Healthcare Common Procedure Coding System (HCPCS) or Current Procedural Terminology (CPT) coding. It provides information about the healthcare services or procedures.

In HCPCS coding, which pertains to billing for Medicare and Medicaid, a QW modifier is used to identify “waived” laboratory tests. The modifier is defined as per the Clinical Laboratory Improvement Amendments (CLIA) program.

CLIA establishes quality standards for all laboratory testing performed on humans in the United States. It is overseen by the Centers for Medicare & Medicaid Services (CMS). ‘Waived’ is CLIA's classification for laboratories performing tests that are simple and have a low risk of error.

The payment for these waived tests is bundled with the payment for the other medical services. A healthcare provider submits a bill using the correct HCPCS code and includes the QW modifier. It shows that the test meets the waived criteria. Medicare and Medicaid could then provide reimbursement to the provider for the test's expenses.

Upcoding

Upcoding in medical billing is an illegality wherein a healthcare provider or facility assigns higher billing codes to medical procedures or services than what was actually performed.

Why? The greedy intention of receiving a higher reimbursement from insurance companies or Medicare and Medicaid.

Here is an example: A provider bills a patient examination as a complex and expensive procedure when in reality, the patient was given a basic medical exam.

Upcoding is considered healthcare fraud and can result in penalties and fines for healthcare providers and facilities, as well as potential criminal charges.

Here are a couple of grim repercussions of engaging in upcoding:

-

In 2014, Tennessee-based home health provider CareAll Management LLC had to pay a whopping $25 million to the United States and the state of Tennessee in settlement of allegations that it upcoded home health billings to Medicare and Medicaid

-

Medical device manufacturer EndoGastric Solutions, Inc. returned $5.25 million to the federal government to settle upcoding allegations. EndoGastric advised providers to bill for a more invasive and expensive procedure when promoting its device, causing federal healthcare programs to pay more than needed.

Needless to say, stay away from any billing practices that may even remotely resemble upcoding.

Local Coverage Determination (LCD)

For those wondering what is LCD in medical billing, the term entails “determining” the eligibility of medical coverage and payment rules for medical services or procedures that are billed for reimbursement.

The so-called “determinations” are carried out by a Medicare Administrative Contractor (MAC) who, are private players contracted by the CMS to process Medicare claims. They provide services to Medicare beneficiaries and healthcare providers, among other tasks.

There are currently twelve MACs that process Medicare claims for different regions of the United States. Each MAC is responsible for a specific geographic area and has its own LCD policies–hence the term “local.”

LCDs can be challenged by healthcare providers and other interested parties. If a provider disagrees with an LCD or believes that it is incorrect, they can go through a formal process to challenge the determination.

National Coverage Determination (NCD)

Similar to LCD, National Coverage Determination (NCD) refers to a decision made by the CMS on whether a particular medical service, procedure, or device is covered by Medicare, nationwide. Unlike LCDs that are decided upon by MACs and apply to specific geographies in the country, NCDs are agreed upon by CMS based on evidence from medical literature, expert opinions, and public comments, among other factors.

NCDs apply to all Medicare beneficiaries across the country and provide guidance to healthcare providers on whether a particular service or procedure is covered by Medicare and under what circumstances. NCDs are typically more broad and general than LCDs and cover a wider range of medical services and devices. Also, LCD’s cannot be more restrictive than NCD.

A thorough grasp of what is LCD and NCD is crucial for correct and accurate Medicare billing.

Get the Edge on Medicare Billing Terms and Nuances With BillPRO

Navigating the complex realm of Medicare billing is no easy task. There are a lot of moving parts, including the terminologies we’ve discussed here.

Navigating the complex realm of Medicare billing is no easy task. There are a lot of moving parts, including the terminologies we’ve discussed here.

At the end of the day, healthcare service providers who are aware of these terms can improve their chances of reimbursement. Others may lose out on worthy and valuable reimbursements.

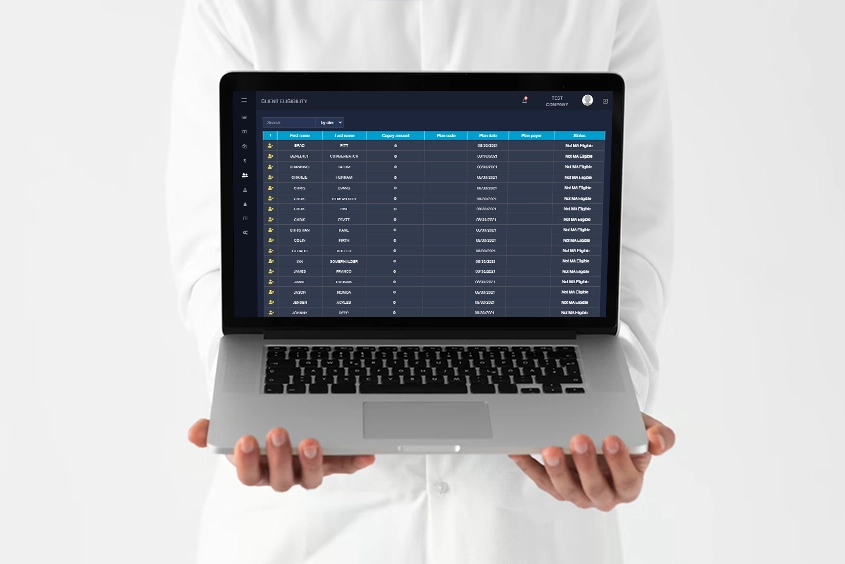

Fortunately, solutions like BillPro can help navigate the complex world of Medicare billing with ease. The solution houses all essential (and beyond) medical billing features. Designed for the non-emergency medical transportation industry, BillPro helps streamline Medicare billing.

Demo BillPro for free today and unlock hassle-free Medicare billing. Hundreds of companies in the healthcare industry rely on BillPro to drive away their Medicare billing hassles.

P.S. Here you can find the first part of popular medical billing codes.

0/5 (0 votes)

0/5 (0 votes)

241 views

241 views